US Distillates Market begins to feel the pinch

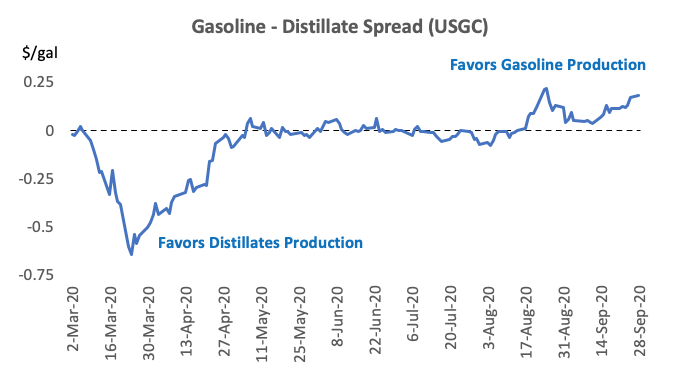

Since the pandemic started and we saw Jet demand drop to levels unseen in many years, I have postulated that distillates will go long in a significant and difficult to deal with way in the US. This is due to the need to blend or fractionate a significant amount of Jet production into primarily the distillate pool (and to a lesser extent the gasoline pool). Confounding that is a meaningful drop in diesel demand which trends with GDP. I made the call that gasoline-diesel spreads would shift to favor gasoline as early as April 15th in a company internal post (note this was while diesel was strongly favored), and more recently highlighted the discord that existed between distillate supply and demand and its pricing in this IMUBIT Blog post as it was still baffling me.

Well, looks like we have finally arrived after seeing this trend crescendo with traders Trafigura and Vitol reportedly storing/shipping distillates on VLCCs to capture contango and arbitrage plays. In the last month we have now seen distillates trade more significantly under gasoline, finally signaling refineries to adjust conversion and potentially even begin some layers of distillate cracking.

Source: EIA Pricing Data

Really it will take a tankage crunch to beat down distillates prices though because as I mentioned last time, the strong contango is powering the aforementioned storage plays which is propping up distillate prices and helping to alleviate tankage constraints. The long term market view will have to change to shift down the absolute price of distillate, but I do believe that process has started over the last few weeks and over time will help change conversion economics at refineries and rebalance the market to the proper product mix for current demand.

How will this affect refiners? If we see significant gasoline over diesel economics, obviously conversion unit signals will shift towards gasoline production. Additionally, though, we should see some tiers of distillate become attractive into the FCCUs competing against import feeds. These two things combined will likely result in reduced overall crude rates for the same gasoline rate (remember that market is only slightly drafting as we head into the winter). We have even seen some simulations show that moving slightly to the gasoline side of maximum volume yield may be economic under these conditions.

Ethylene prices and Ethane Cracking margins increase

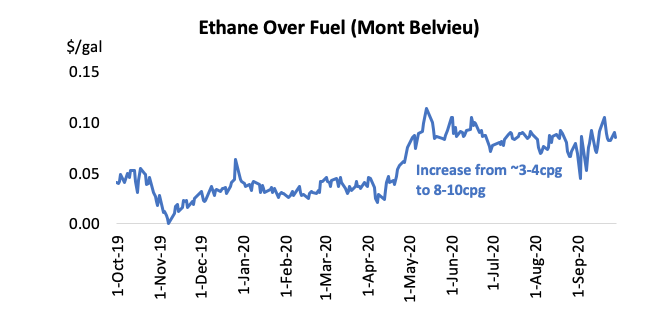

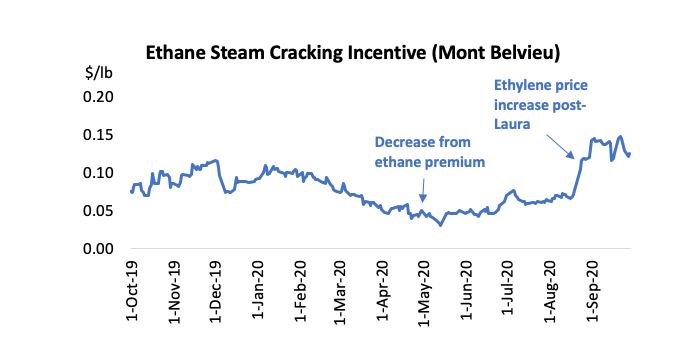

As natural gas production decreased slightly with COVID production curtailments, we did see ethane rise above fuel value a bit more to about 8-10 cents per gallon as ethane must be recovered from longer distances away. While this impacted ethane margins by a couple cents, the new-build ethane cracking fleet appears to have made it to (at least temporarily) greener pastures as ethylene prices increased to around 24 cents per pound following Hurricane Laura. This has brought ethane margins back to more typical levels for the time being.

Sources: EIA HH Natural gas, Nov 2020 MB Ethane Futures, Nov 2020 MB Ethylene Futures